Overview

The Arizona sales tax is known as

Transaction privilege tax (TPT). TPT is a tax on a vendor for the privilege of doing business in the

state of Arizona. If your business sells products or provides services

subject to TPT, you are responsible for paying the taxes on your

applicable gross receipts. Authorization to do business and be able to

pay the tax, requires a license administered by the

Arizona Department of Revenue (ADOR)

. ADOR collects the tax for the counties and cities. Tax rates vary

depending on the type of business activity, the city, and the county.

The tax payments required by TPT may be passed on to your customer. An

Arizona Resale Certificate, Form 5000A

, must be provided to your vendors which allows them to defer the

responsibility of the sales tax to your business. It is now your

responsibility to manage the sales taxes and remain in compliance with

state and local laws. Not staying in compliance may lead to penalties

and interest charges.

For further guidance, refer to ADOR for

TPT Tutorials,

TPT Notices and Correspondence Resource Center, and

TPT Forms.

- Economic Nexus

- Register for a TPT License

- File and Pay your Liability

Economic Nexus

In Latin, nexus nexus means "to bind or

tie." Nexus describes the connection a business has to Arizona. It

decides whether the state has the authority to require your business to

file and pay TPT.

Arizona nexus

is triggered when your business has a physical presence in the state or

a virtual connection to the state such as

out-of-state sellers.

Register for a TPT License

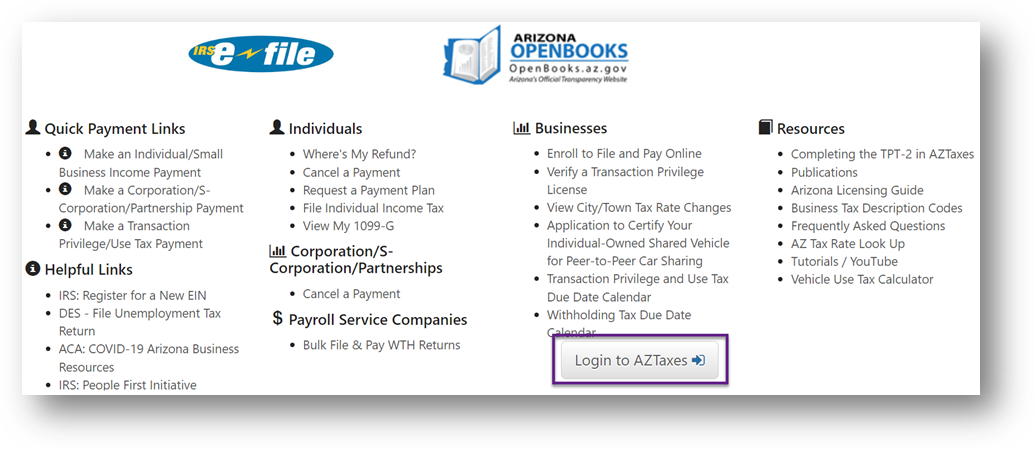

To register for a license, go to

AZTaxes.gov. Select Login to AZTaxes.

On the Business User Login page, select

New User Enrollment.

The welcome page displays information regarding your registration.

Select Continue to begin your registration.

- Business name, address, and contact information

- Federal EIN number

- Date business activities began or will begin

- Projected monthly sales

- Projected monthly taxable sales

- Products to be sold

File and Pay your Liability

Remember that TPT is a two-step process. You must first file a return to

notify ADOR of the current period's tax liability and then you must pay

the liability.

Follow the

step-by-step instructions

provided by ADOR.

ADOR allows individuals to file paper returns if their annual tax

liability is $500 or less. ADOR strongly encourage all taxpayers to file

and pay using the

online tax system

for fast and efficient processing.

-

Annual

- Less than $2,000 estimated annual combined tax liability

-

Quarterly

- $2,000 - $8,000 estimated annual combined tax liability

-

Monthly

- More than $8,000 estimated annual combined tax liability

-

Seasonal

If you have no TPT due for the filing period, you must still file a

return. When filing through AZTaxes.gov, select “No Gross Receipt to

Report.”

ADOR provides the

filing due dates

for all filing frequencies.