Overview

You might be able to claim a significant tax deduction for the business

use of your space. If you're working from the comfort of your own home,

whether that's a cozy apartment, a sprawling house, or even a unique

living space like a boat, you might be able to save on taxes.

What does it take to qualify? Whether you're storing inventory or using

a part of your home as an office, there are specific criteria to meet.

Daycare providers, you're in for some special rules tailored just for

you.

Once you qualify, you're ready to calculate your deductions. There are

two ways to do this: the detailed route of itemizing actual expenses or

opting for the simplified method, which will save you time and

paperwork.

This brief on

IRS Publication 587, Business Use of Your Home, speeds up securing your home office deduction. Pub 587 is 34 pages

long. This is compressed so refer to the official publication when

making decisions for the most up-to-date policies and procedures.

What you'll learn...

- Qualifying for a Deduction

- Figuring the Deduction

- Recordkeeping

Qualifying for a Deduction

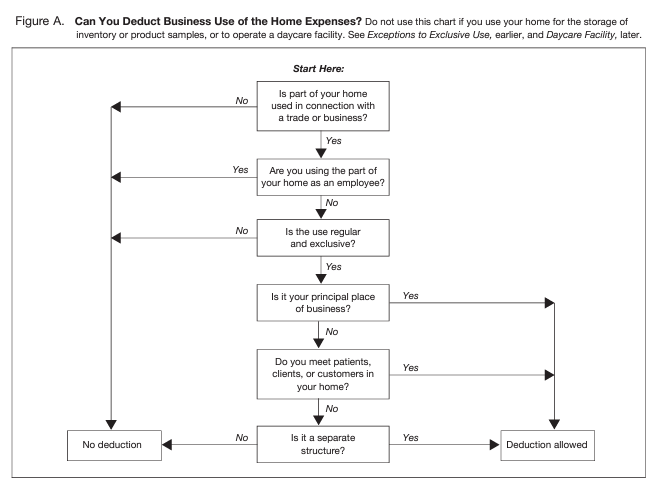

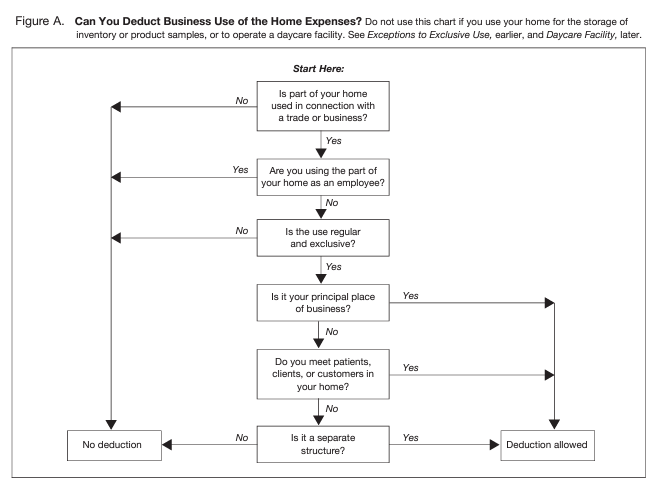

To claim deductions for the business use of your home, you must meet

specific criteria. Normally, common home expenses like mortgage

interest, real estate taxes, and utilities aren't deductible as business

expenses. But, if part of your home is used exclusively and regularly

for business purposes, you may be eligible for deductions. This includes

using your home as your principal place of business, meeting clients or

customers, using a separate structure on your property, or using your

home for storage related to your business.

- Exclusively and regularly as your main place of business

-

Exclusively and regularly for meeting clients or customers in your

trade or business

-

For a separate, unattached structure used in connection with your

business

- Regularly for storage of inventory or product samples

- For rental purposes (see Pub. 527)

- As a daycare facility

Exclusive Use Test

To qualify for the home office deduction under the exclusive use test, a

specific area of your home must be used only for your trade or business.

This area could be a room or another defined space, and it doesn't

require a permanent partition to qualify. However, if the space is used

for both business and personal activities, it does not meet the

exclusive use criterion.

For example, if you are an attorney using your home den to write legal

briefs, but your family also uses it for recreation, you cannot claim a

deduction for its business use.

Exceptions to the Exclusive Use Test

- Operate a wholesale or retail business,

- Store inventory or product samples at home for business use

- Have your home as the sole fixed location of your business,

- Use the storage space regularly,

- Utilize a separately identifiable area suitable for storage.

For instance, if you sell mechanic's tools and use half of your basement

for storage while occasionally using it for personal purposes, you can

still deduct expenses for this space.

If you use part of your home as a daycare facility, the exclusive use

requirement does not apply.

Outside of these two exceptions, any part of your home used for business

must pass the exclusive use test to qualify for deductions.

Regular Use Test

To meet the regular use test, you need to use a designated area of your

home for business activities on a consistent basis. Using the space

occasionally is not enough. When determining if your usage qualifies as

regular, you should assess all relevant facts and circumstances. Regular

use is key to establishing that part of your home is genuinely dedicated

to your business activities.

Trade or Business Use Test

To pass the trade-or-business-use test, you must use a portion of your

home specifically for your trade or business activities. Simply engaging

in profit-seeking activities does not qualify unless they are part of an

established trade or business.

For example, if you use a part of your home to read financial

periodicals and engage in investment-related activities for personal

investment purposes, and not as a professional broker or dealer, these

activities do not qualify as a trade or business. Therefore, you cannot

claim a home office deduction. This test emphasizes the need for the

space to be used in connection with a genuine business operation.

Principal Place of Business Test

-

Relative Importance: Consider the importance of the activities

performed at your home compared to other locations where you conduct

business.

-

Time Spent: Assess how much time you spend working from each business

location.

-

You use it exclusively and regularly for the administrative or

management tasks of your business.

-

There is no other fixed location where you conduct substantial

administrative or management activities for your business.

A Home Office for More Than One Trade or Business

Your home office can serve as the principal place of business for more

than one distinct trade or business. However, it's important to evaluate

each business activity separately to determine if the office qualifies

as the principal place of business for each.

-

As the principal place of business for one or more of your trades or

businesses.

-

As a location to meet or deal with patients, clients, or customers in

the normal course of your business activities.

-

If the office is a separate structure on your property, it must be

used in connection with your trades or businesses.

Home Office Expenses for Meeting Patients, Clients, or Customers

-

Physical Meetings: You must physically meet with patients, clients, or

customers in your home.

-

Substantial and Integral Use: The use of your home for these meetings

must be substantial and integral to the operation of your business.

This requirement is typically met by professionals like doctors,

dentists, attorneys, etc., who maintain offices in their homes

specifically for these purposes. However, merely using your home for

occasional meetings or telephone calls does not qualify for home office

deductions. Importantly, the area used for meetings does not need to be

your principal place of business, but it must be used exclusively and

regularly for business meetings.

Figuring the Deduction

There are two ways for figuring your home office deduction: the

simplified method and using actual expenses. You can choose which one to

use each year meeting applicable requirements.

Using the Actual Expense Method to Calculate Deductions

-

Determine the percentage of your home used for business purposes.

-

Calculate the actual expenses associated with that portion, such as

utilities, rent, insurance, and depreciation.

- Applying any limitations on the deduction amount.

Part-Year Use: You can only deduct

expenses for the part of the year your home was used for business. For

example, if you start using your home for business on July 1, only

calculate your expenses from July to the end of the year for your

deduction.

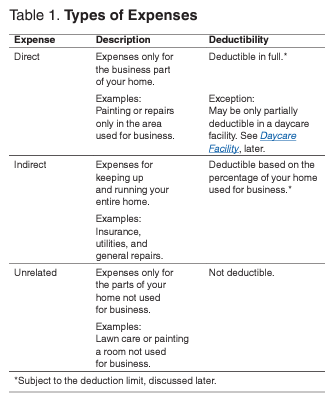

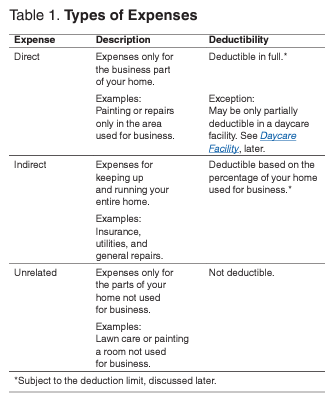

Calculating Deductions for Actual Expenses

When using actual expenses, you must allocate the costs between personal

and business use.

Type of Expense: Is it a direct expense

(solely for the business part of your home), an indirect expense (for

keeping up and running your entire home), or unrelated to the business

use of your home.

Business Use Percentage: The percentage

of your home used for business is used to calculate indirect expenses

you can allocate towards your home office deduction.

Calculating Business Percentage of Home Use

To accurately claim home office deductions, it's essential to determine

the business percentage of your home. This percentage is based on the

proportion of your home that is used for business activities and is

crucial for calculating the deductible portion of home operating

expenses.

Methods for Determining Business Percentage

Use any reasonable method to determine the business percentage. Here are

two common approaches:

Area: Calculate the area (l*w) of the

space then divide it by the total area of your home. For example, a home

office is 100 square feet (10’ x 10’) and your total home area is 1000

square feet, your business percentage is 10%.

Room: If the rooms in your home are

approximately the same size, divide the number of rooms used for

business by the total number of rooms. For example, you use one room as

an office and your home has ten rooms, your business percentage is 10%.

Understanding the Limitations

It's important to understand how gross income from your business affects

the deductible amount of your home office expenses.

Full Deduction Eligibility: If the gross

income from your home-based business equals or exceeds your total

business expenses (which include depreciation), you can deduct all your

business expenses related to the use of your home.

Deduction Limitations: However, if your

business's gross income is less than your total business expenses, the

amount you can deduct for certain home-related expenses may be limited.

First, take the gross income from the business use of your home…

- Mortgage interest

- Real estate taxes

-

Casualty losses related to a federally declared disaster (if you

itemize deductions on Schedule A (Form 1040), or net qualified

disaster losses if you claim the standard deduction).

- Business phone expenses

- Office supplies

- Depreciation on business equipment

After subtracting these amounts, the remaining limit is what you can

claim for otherwise nondeductible home expenses such as utilities,

insurance, and home depreciation. Depreciation of the home is calculated

last.

Using the Simplified Method to Calculate Deductions

The simplified method offers an easier way to calculate your home office

deductions without needing to track and allocate actual expenses. With

this method, you calculate your deduction by applying a set rate of $5

per square foot to the area of your home that's used for business. The

maximum area you can use for this calculation is capped at 300 square

feet. This straightforward approach minimizes the complexity involved in

documenting and substantiating your home office expenses.

Implications of Choosing the Simplified Method

-

Exclusion of Actual Expenses and Depreciation: Choosing the simplified method means you cannot deduct actual

expenses related to the business use of your home, such as utilities,

repairs, or depreciation. The depreciation deduction for the portion

of the home used for business is considered zero for the year.

-

Non-Business-Related Expenses: Mortgage

interest, real estate taxes, and casualty losses should be treated as

personal expenses under the simplified method. If you rent part of

your home, these expenses must still be allocated between the rental

and personal use, which includes the business use calculated using the

simplified method.

-

No Deduction or Carryover of Disallowed Actual Expenses: If you previously used actual expenses for your home office

deduction and some of that deduction was disallowed, you cannot deduct

the carried-over amount in the year you choose the simplified method.

Instead, this disallowed amount must be carried forward to future

years when you might switch back to using actual expenses for your

deduction.

Switching back to actual expenses in subsequent years requires using the

appropriate depreciation tables for Modified Accelerated Cost Recovery

System (MACRS) to calculate depreciation. This approach to home office

deductions simplifies the process for some but may lead to different

financial outcomes depending on your specific expenses and business use

of the home.

Recordkeeping

-

Proof of Expenses: Preserve all

canceled checks, receipts, bills, and other documents that verify the

expenses you're claiming.

-

Usage Details: Your records should

clearly indicate the portion of your home used for business purposes.

-

Nature of Use: Document that you use

this part of your home exclusively and regularly for business, either

as your main place of business or as a place where you meet clients or

customers in the normal course of your business. Remember to note any

exceptions to the exclusive use requirement as discussed previously.

-

Depreciation and Other Expenses: Keep

detailed records of depreciation claimed and all other expenses

related to the business use of your home.

-

3 years after the date you filed your

return or the return's due date.

-

2 years after the date you paid the

tax.

-

Depreciable Basis needs records showing

the purchase price, the cost of any improvements, dates of purchase,

and how you acquired your home. These records are essential for

calculating depreciation.

-

Forms and Worksheets to retain are

Forms 8829 or the Worksheet To Figure the Deduction for Business Use

of Your Home, which can serve as records of your depreciation

calculations.

For more detailed guidelines on recordkeeping practices, refer to IRS

Publication 583, "Starting a Business and Keeping Records." By keeping

accurate and comprehensive records, you can ensure that you are prepared

to substantiate your home office deductions in the event of an IRS

inquiry or audit.