Overview

While running your business, you can deduct certain transportation

expenses without having to travel far from home. These deductions cover

a variety of transportation modes including air, rail, bus, taxi, and

notably, the use of your personal car. There are several ways to

qualify.

Costs incurred while

traveling between different work locations

within your tax home area qualify for deductions. Your tax home is the

city or general area where your business is based. Expenses for

visiting clients or attending business meetings

away from your regular workplace are deductible. You can deduct expenses

when

traveling from your home to a temporary workplace, provided you also have one or more regular workplaces. These

temporary workplaces can be within or outside your tax home area.

If you travel overnight, different rules apply, particularly in

calculating car expenses.

This brief on

Publication 463, Travel, Gift, and Car Expenses, provides a basic understanding to help you get started with your

deductions for business transportation. Pub 463 is sixty-one pages long

and this brief covers

Chapter 4 Transportation and

Chapter 5 Recordkeeping. Refer to the

comprehensive rules laid out in the IRS documentation for detailed

guidance on car expenses and other specific situations.

What you'll learn...

- When Are Transportation Expenses Deductible?

- How to Deduct the Car Expenses

- Recordkeeping

When Are Transportation Expenses Deductible?

Commuting costs are daily expenses of

driving between home and regular workplaces. Generally, they are not

deductible but there are some exceptions. Traveling to a temporary

workplace outside your metropolitan area is deductible. If your home is

your principal place of business, you can deduct transportation costs

between your home and another work location in the same trade or

business, regardless of the work's duration or distance.

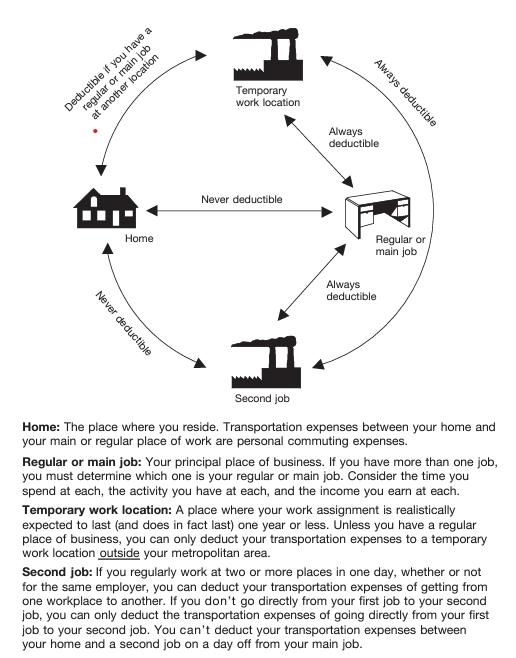

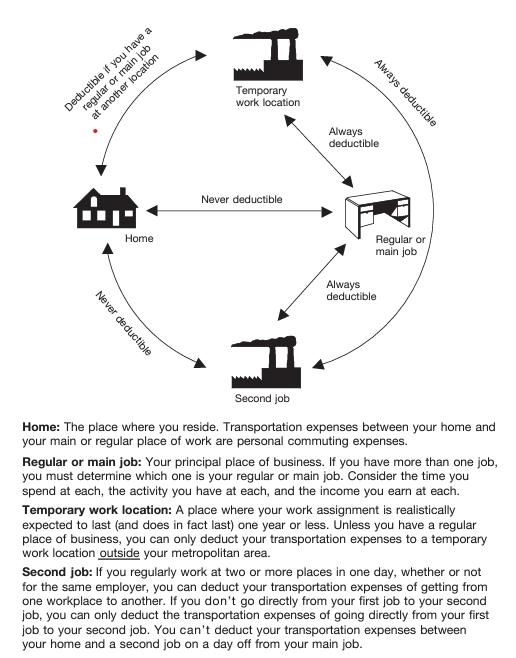

Figure B. When Are Transportation

Expenses Deductible?

If your home is your principal place of business, do not use this

chart.

Temporary Work Location

-

Regular and Temporary Sites: If you

have one or more regular work locations away from your home and

commute to a temporary work location in the same trade or business,

you can deduct daily round-trip.

-

Duration of Employment: A job location

is temporary if it is expected to last for one year or less.

-

Change in Duration: If a job initially

expected to last less than a year extends beyond that, it is still

temporary until your expectations change. Once it is expected to last

more than a year, it no longer qualifies as temporary.

Overnight Stays

If the temporary work location is far enough from your regular work area

that you need to stay overnight, different rules apply. In this case,

you may be eligible for travel expense deductions.

No regular place of work

If you do not have a fixed workplace but usually work within the

metropolitan area where you reside, you can deduct transportation cost.

Temporary Work Sites Outside Your Metropolitan Area

You can deduct transportation costs for travel between your home and a

temporary work location outside your metropolitan area. The metropolitan

area typically includes the city and its suburbs.

Non-Deductible Commuting Expenses

Daily transportation costs between your home and any temporary work

sites within your metropolitan area are not deductible. These are

considered regular commuting expenses and are not eligible for tax

deductions.

Two places of work

When your workday involves traveling between two different job

locations, there are deductions you can take. You can deduct the costs

of traveling directly from one workplace to another within the same day,

regardless of whether these locations belong to the same employer. If

you do not travel directly from one job to the other due to personal

reasons, you can only deduct the amount it would have cost you to travel

directly between the two.

Non-Deductible Commuting Expenses

Costs associated with traveling between your home and a part-time job on

your days off from your main job are considered commuting expenses and

are not deductible.

Commuting Expenses

When it comes to commuting between your home and your primary workplace,

certain costs are not deductible. Expenses incurred while taking public

or driving a car between your home and your main or regular workplace

are non-deductible. These are personal commuting expenses. This

non-deductibility applies regardless of the distance between your home

and your workplace or whether you engage in work-related activities

during the commute.

-

Parking Fees: Costs for parking at your

place of business

-

Advertising Displays on Car: Adding

business advertisements to your car does not convert the vehicle's use

from personal to business for tax purposes.

-

Car Pools: Costs related to

participating in a non-profit car pool are not deductible. However, if

you run a car pool for profit, you can deduct car expenses.

-

Hauling Tools or Instruments: Commuting

with tools or instruments in your car is not deductible, but costs

like renting a trailer are deductible.

-

Union Members' Travel: Costs from

traveling from a union hall to a workplace are non-deductible as your

employment location is considered your workplace, not the union hall.

Business discussions or phone calls made during these trips do not

change their classification from personal to business. Only expenses

directly related to business activities, like visiting clients, are

deductible.

Office in the home

If you maintain a qualifying home office that serves as your principal

place of business, you are eligible to deduct certain travel expenses.

You can deduct the transportation costs for travel between your home

office and another work location within the same trade or business. This

includes the costs of driving your car or using other modes of

transportation to get to these other work locations.

To determine if your home office qualifies as your principal place of

business, refer to

IRS Publication 587, Business Use of Your Home

and

Get the most out of your Home Office Deduction for 2024.

How to Deduct the Car Expenses

Business use of your car makes you eligible to deduct car expenses using

one of two different methods. The

Standard Mileage Rate allows you to

deduct a set amount for each mile driven for business purposes. The

Actual Car Expenses method involves

deducting the actual costs of operating your car for business, including

gas, repairs, insurance, and depreciation.

If you qualify to use both the standard mileage rate and actual

expenses, try to calculate your deduction using both methods to see

which one offers a larger deduction.

-

Under the Tax Cuts and Jobs Act, miscellaneous itemized deductions

subject to the 2% floor are suspended for tax years beginning after

December 2017 and before January 2026. This means you can no longer

claim the cost of using your car as an employee for these expenses as

a miscellaneous itemized deduction.

-

Exceptions: Certain individuals, such

as Armed Forces reservists, qualified performing artists, and

fee-basis state or local government officials, can still deduct

unreimbursed employee travel expenses directly from their adjusted

gross income on Schedule 1 (Form 1040), Line 12.

Standard Mileage Rate

The standard mileage rate is an efficient way to calculate deductible

costs. The rate is 65.5 cents per mile. If you cannot or choose not to

use the standard mileage rate, you will calculate your car deduction

using actual expenses.

-

Exclusive Use: If you choose the

standard mileage rate for any year, you cannot claim actual car

expenses for that year.

-

First-Year Choice: To use the standard

mileage rate, you must use this method in the first year your car is

used for business. In subsequent years, you can switch between

standard mileage and actual expenses.

-

Leased Vehicles: For leased vehicles,

if you choose the standard mileage rate, you must continue to use it

for the entire lease period.

-

If you use five or more vehicles simultaneously (like in fleet

operations).

-

If you have claimed a depreciation deduction using any method other

than straight-line for the estimated useful life of the car.

-

If you used the Modified Accelerated Cost Recovery System (MACRS) for

depreciation.

-

If you have claimed a Section 179 deduction, a special depreciation

allowance, or have claimed actual car expenses after 1997 for a leased

car.

Switching from Standard Mileage to Actual Expenses

If you switch to actual expenses after initially using the standard

mileage rate, you must use straight-line depreciation for the remaining

estimated life of the vehicle, adhering to specific depreciation limits.

Reimbursements

If you switch to actual expenses after initially using the standard

mileage rate, you must use straight-line depreciation for the remaining

estimated life of the vehicle, adhering to specific depreciation limits.

Car for Hire

If you switch to actual expenses after initially using the standard

mileage rate, you must use straight-line depreciation for the remaining

estimated life of the vehicle, adhering to specific depreciation limits.

-

Five or More Cars: If you own or lease

five or more cars that are used for business simultaneously, you

cannot use the standard mileage rate for any of them. In this case,

you would need to calculate your deductions based on actual car

expenses.

-

Alternating Vehicle Use: If you

alternate the use of these cars for business (meaning you do not use

them at the same time), this rule does not apply, and you may still be

eligible to use the standard mileage rate.

Interest on Car Loans

If you are self-employed and use your car for business, you can deduct

the portion of the interest expense that corresponds to the business use

of the car. For example, if 60% of your car's use is for business, you

can deduct 60% of the interest expense on Schedule C (Form 1040).

If you finance your car purchase through a home equity loan, you might

be able to deduct the interest. Reference IRS Publication 936, "Home

Mortgage Interest Deduction," for more details.

Personal Property Taxes

You can deduct the business portion of state and local property taxes

for motor vehicles.

Parking Fees and Tolls

Business-related parking fees and tolls are deductible, even if you use

the standard mileage rate. However, parking fees at your regular place

of work are considered nondeductible commuting expenses.

Sale, Trade-in, or Disposal of a Car

If you sell, trade in, or dispose of your car in any way, you may need

to calculate gain or loss for the transaction, or adjust the basis of

your new car.

Actual Car Expenses

If you opt not to use the standard mileage rate, you can deduct the

actual expenses associated with using your car for business. If your car

serves both personal and business purposes, you must allocate expenses

based on usage. For example, if 60% of your driving is for business, you

can deduct 60% of your total car expenses.

-

Operating Expenses: Gas, oil, and

repairs.

-

Ownership Costs: Depreciation,

licenses, registration fees, lease payments, and insurance.

-

Other Expenses: Garage rent, parking

fees, and tolls.

Continued Deductions for Fully Depreciated Vehicles

Even if your car is fully depreciated, you can continue to deduct other

operating costs associated with business use. Maintain proper records to

support your deduction.

-

Interest on Car Loans: Interest is

deductible. See

Interest on car loans under the

Standard Mileage Rate.

-

Taxes and Sales Tax: Sales taxes are

added to the car's basis and recovered through depreciation.

-

Fines and Collateral: Expenses related

to traffic violations are not deductible.

-

Casualty and Theft Losses: Losses not

covered by insurance may be deductible under certain conditions. Refer

to

IRS Publication 547, Casualties, Disasters, and Thefts, for details.

-

Capital Expenses: The cost of the car,

including sales tax and improvements, typically is not deductible

immediately but can be depreciated.

-

Section 179 Deductions: Allows for an

immediate deduction of part or the entire purchase price of the

vehicle, subject to certain limitations and conditions.

-

Standard Vehicle Definition: For

depreciation, a car includes any four-wheeled vehicle primarily for

use on public streets with an unloaded gross vehicle weight of 6,000

pounds or less.

-

This definition excludes vehicles like ambulances or hearses used

directly in a business, or vehicles used for transporting persons or

property for pay.

Qualified Nonpersonal Use Vehicles

Vehicles modified for business (e.g., with permanent shelving or company

logos) and unlikely to be used for personal purposes, like certain

delivery trucks, qualify for different depreciative treatment.

Section 179 Deduction

Section 179 deductions allow businesses to deduct the full purchase

price of qualifying vehicles and other assets used in a business,

subject to certain limits.

Eligibility and Limits

You can elect to deduct the cost of a car that qualifies as Section 179

property in the year you place it in service. The vehicle must be used

more than 50% for business to qualify for the Section 179 deduction. If

it's used less, the benefit might be reduced or eliminated.

-

2023 Deduction Limit: The maximum

deduction in 2023 is $1,160,000.

-

Total Investment Limitation: This

begins to phase out dollar-for-dollar after $2,890,000 of total

property is placed in service during the tax year, eliminating the

deduction entirely above $4,050,000.

-

Specific Vehicle Limit: For certain

heavy vehicles, including some SUVs primarily designed to carry

passengers, the deduction is capped at $28,900.

Special Considerations for Vehicles

- $12,200 for vehicles before September 28, 2017

-

$20,200 after September 27, 2017, unless you do not claim the special

depreciation allowance, then $12,200.

Electing the Deduction

The election must be made in the year the car is placed in service. Use

Form 4562 for depreciation and amortization.

-

Business Use Decline: If the business

use of the vehicle drops to 50% or less in subsequent years, you must

recapture (reclaim as income) any excess depreciation claimed. This

includes adjusting for any Section 179 deduction taken.

-

Recapture Process: This involves

reporting the recaptured amount as ordinary income in the year the

business use falls below 50%.

Disposing of the Vehicle

When you dispose of a vehicle on which you've claimed the Section 179

deduction, the deduction is treated like any other depreciation for

recapture purposes. Any gain on the sale is considered ordinary income

up to the amount of the Section 179 deduction plus any allowable

depreciation.

Refer to

IRS Publication 946, How to Depreciate Property, for comprehensive information on depreciation rules.

Leasing a Car

When leasing a vehicle for business, you can choose between the standard

mileage rate or actual expenses to calculate your deductible costs.

-

Business Use: You can deduct the

portion of each lease payment that corresponds to business use.

-

Advance Payments: Any upfront payments

made at the start of the lease must be spread out over the entire

lease term for deduction purposes.

-

Purpose: For leases of 30 days or more,

you may need to reduce your lease payment deduction by an inclusion

amount. This adjustment mirrors what would happen with depreciation

limits if the vehicle were owned rather than leased.

-

Calculation: The inclusion amount is

calculated by taking a portion of the vehicle's fair market value,

multiplied by the percentage of the vehicle's business use, then

prorated for the number of days in the tax year.

-

Definition: This is the price at which

the vehicle would sell under normal conditions.

-

Use in Calculations: Determine the fair

market value on the first day of the lease term; if your lease

agreement specifies a capitalized cost, use this as the fair market

value.

-

Identify the Relevant Appendix:

Depending on the year the vehicle was placed in service; you will

refer to a specific IRS appendix that provides inclusion amounts for

different fair market values.

-

Prorate the Amount: Adjust the

inclusion amount from the appendix based on the number of days in the

tax year the lease covers.

-

Apply Business Use Percentage: Multiply

the prorated amount by the percentage of the vehicle's business use.

-

2023 Lease Example: If you leased a car

on January 17, 2023, with a fair market value of $62,500 and used it

75% for business, you would refer to Appendix A-6 and adjust the

inclusion amounts for each tax year based on usage and days in the

year.

-

Change in Use Example: If you initially

leased a vehicle for personal use but later switched to business use

(like starting a self-employed consulting job), you must reassess the

fair market value at the time of conversion and calculate inclusion

amounts accordingly.

Reporting Requirements

Reporting for sole proprietors and farmers should be done through

Schedule C or Schedule F of Form 1040, respectively

Disposition of a Car

When you dispose of a car used for business, consider the various tax

outcomes selling, trading in, or losing the car to a casualty or theft.

-

Depreciation Recapture: Any gain on the

sale of the vehicle with depreciation deductions taken in previous

years is taxed as ordinary income. This includes Section 179

deduction, clean-fuel vehicle deductions, and special depreciation

allowances.

-

Casualty or Theft: If the car is

disposed of due to casualty or theft, and you receive insurance

proceeds exceeding the car's adjusted basis, you may realize a gain.

However, if you reinvest the insurance proceeds in similar property

within a specific time frame, you might not have to recognize this

gain. The basis of the new property is its cost minus any deferred

gain.

-

Publication 544: For detailed guidance

on how to report the disposition of a car, refer to IRS Publication

544, which covers sales and other dispositions of assets.

-

Like-Kind Exchanges: For exchanges

completed after December 31, 2017, like-kind exchanges are generally

limited to real property not held primarily for sale. When you trade

in your car for another car, typically no gain or loss is recognized

if the exchange qualifies as like-kind.

-

Standard Mileage Rate: If you used the

standard mileage rate to deduct car expenses, depreciation is included

in that rate. You must adjust the basis of your car by the amount of

depreciation factored into the standard mileage rate over the years of

usage.

-

Actual Expense Method: If you used the

actual expense method, refer to the depreciation tables in Publication

946 to calculate depreciation for the year of disposition, adjusting

for any applicable conventions (e.g., half-year or mid-quarter).

Practical Example

Imagine you purchased a car for $25,500 in 2018 and used the standard

mileage rate to calculate car expenses. Over the years, you accumulated

a total depreciation deduction of $24,415. By the end of 2023, the

adjusted basis of the car is $1,085. If you dispose of the car at this

point, any sale price above $1,085 would potentially be subject to tax

as a gain, largely as ordinary income due to depreciation recapture.

-

Quarter of Disposal: If disposing of

the car within the recovery period using the actual expenses method,

the depreciation deduction for the year of disposal must be adjusted

based on the quarter in which the car is disposed, using percentages

provided in Publication 946.

-

Depreciation Limits: Ensure that the

calculated depreciation does not exceed the limits set by the IRS,

adjusting as necessary.

Recordkeeping

Proper recordkeeping is essential for proving transportation expenses

and staying ready to withstand scrutiny if necessary. To effectively

prove your business expenses, you need to maintain timely and accurate

records that can support each element of the expense. Document the cost

of the car, the date you started using it for business, business

mileage, and total annual mileage.

Adequate records include an account book,

diary, log, trip sheet, or similar record, and must be kept in a written

format. A computer record is considered written documentation.

- Amount of the expense

- Date the expense happened

- Place or location of the expense

- Purpose of the expense

- Expenses under $75 except lodging

-

Transportation expenses where a receipt is not readily available

-

Timely Recordkeeping: The IRS places

great value on records that are kept at or near the time the expense

is incurred. A weekly log can be sufficient if it accurately reflects

the entire week's expenses.

-

Regular Updates: Regular updates to

your records help in maintaining their accuracy and relevance.

-

Confidential Information: If your

records include confidential information, ensure it's recorded in a

secure and compliant manner.

-

Invoices and Bills: Invoices and other

forms of direct evidence can supplement your records, especially for

ongoing business uses like deliveries.

-

Destroyed Records: In cases where

records are destroyed due to circumstances beyond your control, such

as natural disasters, you may reconstruct these records to

substantiate your claims.

Record Retention

Keep your records for at least three years from the date you file your

income tax return on which the deduction is claimed. For business use of

a car, maintain records for each year of the recovery period.